By Abdi Ali

Published September 25, 2016

International air travel to East Africa has over the first eight months of 2016 registered an 11 times growth rate.

International air travel to East Africa has over the first eight months of 2016 registered an 11 times growth rate.

ForwardKeys, a company that analyses international air travel shows strong growth of 11.2% compared with the same period the previous year.

RELATED:Rwanda to Host Aviation and Hotel Development Forum

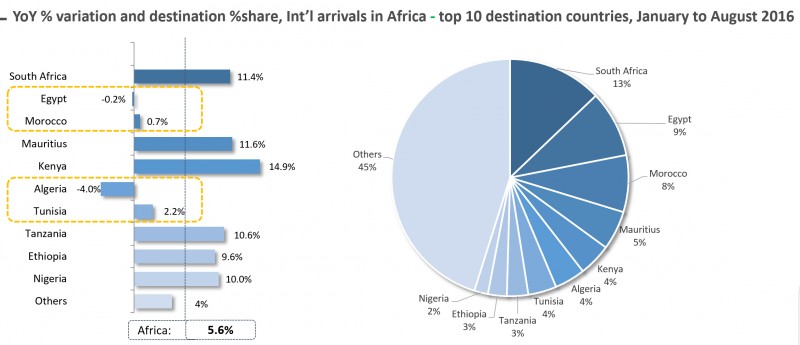

This, ForwardKeys stresses, is an exceptional performance as growth for Africa as whole has been 5.6%, with countries like Algeria, Egypt, Morocco and Tunisia seeing little growth or even a decline.

Olivier Jager, CEO of ForwardKeys, says, “We are seeing a tale of two Africas, with North African countries suffering from political instability and terror activities and sub-Saharan African countries powering ahead, with Ethiopia up 9.6%, Tanzania up 10.6%, Mauritius up 11.6% and Kenya up 14.9%. South Africa is up 11.4%.”

ForwardKeys sees this trend as being ‘highly encouraging for East Africa’ whose international bookings for travel up to the end of December 2016 are 17.3% ahead of where they were at this time in 2015.

“Looking at the main origin markets,” ForwardKeys says, “the UK is 13.2% ahead, Germany is 21% ahead, The USA is 21% ahead, France is 16.1% ahead, the Netherlands is 16.6% ahead, South Africa is 9.4% ahead and India is 34% ahead.”

RELATED:Travel Ideas and Deals From Nairobi for December 2015

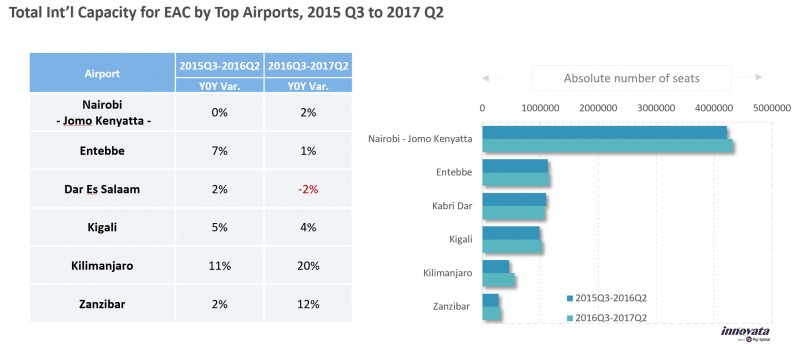

An analysis of airport capacity, defined by the total number of seats, reveals that the stars in terms of growth are Nairobi, Kigali and Kilimanjaro.

An analysis of airport capacity, defined by the total number of seats, reveals that the stars in terms of growth are Nairobi, Kigali and Kilimanjaro.

Looking at international capacity in the periods July-September (Q3) 2015 – April-June (Q2) 2016 and July-September (Q3) 2016 – April-June (Q2) 2017, Nairobi grew 0% and 2% respectively; Kigali 5% and 4%, respectively; and Kilimanjaro 11% and 20%, respectively. While a 2% growth for Nairobi may not sound so impressive, ForwardKeys observes, its capacity is around four times that of Kigali.

RELATED:Global Standards to Drive Commercial Aviation’s Second Century

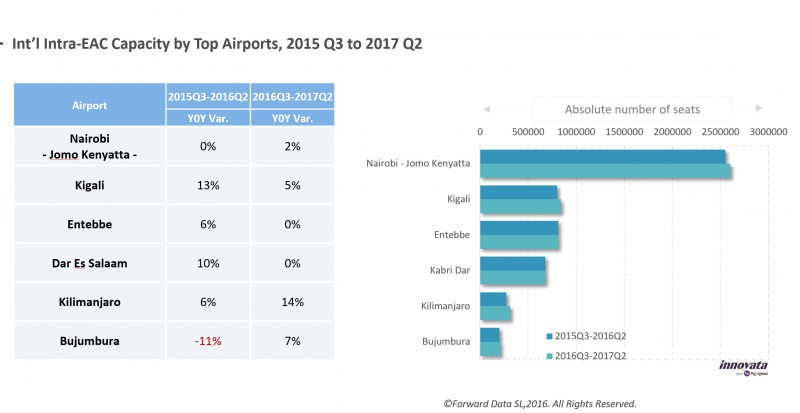

On capacity for flights within East Africa in the periods Q3 2015 – Q2 2016 and Q3 2016 – Q2 2017, Nairobi grew 0% and 2%; Kigali 13% and 5%; and Kilimanjaro 6% and 14%, respectively.

The data has been released ahead of Aviation Development (AviaDev), a new airline route development conference and Africa Hotel Investment Forum (AHIF), Africa’s highest profile hotel investment conference, which run concurrently at the Radisson Blu Hotel & Convention Centre in the Rwandan capital, Kigali, October 4-6, 2016.

The data has been released ahead of Aviation Development (AviaDev), a new airline route development conference and Africa Hotel Investment Forum (AHIF), Africa’s highest profile hotel investment conference, which run concurrently at the Radisson Blu Hotel & Convention Centre in the Rwandan capital, Kigali, October 4-6, 2016.

RELATED:Kenya Targets Tourism through Endurance Sports

Jonathan Worsley, Chairman of Bench Events, which is organising AHIF and AviaDev, says, “We are seeing unprecedented interest in the AHIF AviaDev combination, with over twenty airlines signing up to talk about new air routes, with global CEOs of the world’s biggest hotel companies present to discuss their plans for Africa and with government ministers keen to attract inward investment; one has to ask: ‘Why is there such serious interest?’ These highly encouraging booking figures explain it.”

Jonathan Worsley, Chairman of Bench Events, which is organising AHIF and AviaDev, says, “We are seeing unprecedented interest in the AHIF AviaDev combination, with over twenty airlines signing up to talk about new air routes, with global CEOs of the world’s biggest hotel companies present to discuss their plans for Africa and with government ministers keen to attract inward investment; one has to ask: ‘Why is there such serious interest?’ These highly encouraging booking figures explain it.”

RELATED:Culinary Tourism is the Fastest Growing Interest Among Travellers

In Rwanda, a new airport is under construction 25km outside Kigali, with the ability to cater for 4.5 million passengers per year, seven times today’s traffic, Worsely says. The national airline has invested in new aircraft and set itself ambitious growth plans and the government is actively promoting Rwanda as a destination for conferences and exhibitions.